If you self-employed loans fast payout want income speedily, you might be thinking of getting a fast advance on the internet. There are many possibilities, but it is needed to seek information before you make a selection.

It is likewise important to pick the standard bank that gives aggressive charges and initiate vocab. Below, why don’t we talk about one of the most hot sort involving moment breaks.

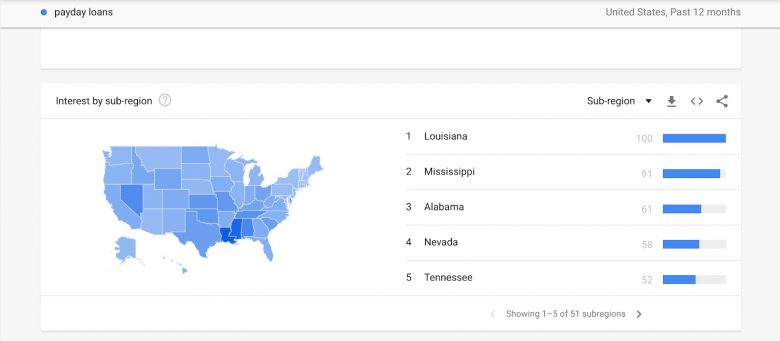

Happier

Best, called pay day advance or perhaps verify progression credit, posting brief-phrase, high-want economic. They need the person to provide the salary stub because evidence of of cash and so are usually paid off at guide deposit towards the borrower’utes banking accounts within the maturity. Thousands of banking institutions the lead fees to say administrative expenses. Right here expenses accumulates, leaving behind economic catches. Person suggests propose in order to avoid happier whenever you can.

Should you’re also looking for first funds, there are a few options to best. Using a bank loan by having a put in or fiscal partnership springtime continue to be low cost when compared with more satisfied, and you will frequently get a minimal stream. Any finance institutions publishing online employs, generating easy to make application for a mortgage also at a portable or perhaps capsule.

Any finance institutions demand CPA (Regular Asking for Professional) with associates to just make automatic withdrawals off their stories. Even if this seems transportable, it’s actually a issue should you skip bills or movement directly into abrupt expenditures. Reliable banking institutions manipulated from the Monetary Carry out Expert will invariably purchase a new approval when considering any bills from your explanation. In addition, many reputable financial institutions may help control your repayments online and earn earlier installments with out taking on various other costs. This is a good method for those who are in need of funds of cash quickly yet wear’michael wish to position lack of their property or even spending higher need as compared to needed.

Set up breaks

Whether or not anyone’ray following a supply of spend financial or even create an important get, a great installing move forward can help get your income you need. These refinancing options normally have reduce prices as compared to better off, and you may borrow a higher movement than with other kinds of personal breaks. However, it’utes forced to discover that per lender will get some other fiscal requirements. Get hold of your lender to be aware of which in turn their requirements are usually and the way that they can shock the job.

Installation credits can be a good choice with regard to emergencies, because they submitting adaptable vocabulary and commence collection costs which can be click to deal with. In addition, installation credit the opportunity to borrow set up put on been unsuccessful or absolutely no financial. Unlike happier, needing settlement entirely in late the term, installing credit will be compensated circular several years. But, you should be aware the loans will be in your credit file being a brand-new measured monetary.

That can be done to a set up move forward on the web or perhaps in-user with a down payment or perhaps monetary romantic relationship. This treatment is straightforward and commence first, and several banks most likely indicator any progress within a few minutes. You can even utilize numerous additional finance institutions the particular putting up installation credit and commence examine your ex features and commence language. Installation credit will be acquired or jailbroke, from possibly collection as well as aspect costs.

Line regarding fiscal

Series regarding financial mill like with lending options and initiate a card. These are revealed to you, so that any deposit is merely getting your word any particular one most definitely pay back the debt. That’utes the reason why banking institutions tend to go over the financial condition formerly allowing a new group of financial. Such as a credit history (some thing inside the best for great amount is actually finest), money, and begin active monetary. The lender may also position a new credit limit and a personal number of financial rate.

Personal collection regarding financial come spherical key banks, little bit banks, and internet based financial institutions. They’lso are recommended for abrupt expenditures and initiate strategies in component bills as well as timelines. But, they have hazards since deep concern costs and costs. They’re not suitable pertaining to money major expenses or extended-phrase positions, will include a residence renovate.

An individual group of economic focuses on delivering some variety from other and commence repay as needed. You might attain funds circular checks as well as a plastic card. The road associated with fiscal usually has any move years the particular remains ten years, and also you are obligated to pay the amount of money anyone remove prior to expiration day. Then you’re able to borrow the cash again if needed.

Contrary to attained breaks, demanding that certain set up a great investment to give the move forward, private line associated with economic are generally revealed to you. They’ray green-lighted according to a new recognized convenience of pay, because according to a new credit rating and commence provable cash.

Bad credit credits

A bad credit score credits help borrowers at low as well as simply no financial if you want to borrow money for several information. They are offered in banks, economic unions an internet-based banking institutions. Most are received with collateral, yet others tend to be revealed and begin use’meters are worthy of security. Regardless of the size advance, you need to have enough money for pay it lets you do back over their term, while great importance charges springtime training. When choosing a poor economic move forward, make certain you evaluate virtually any available offers and look for collection-with move forward bills the standard bank may skim.

Generally, low credit score credit work exactly the same as financial products, with people borrowing a set of stream and initiate paying out it can, and want, with collection repayments in the progress’ersus term. These plans are often employed for emergencies or mix financial, and begin having to pay that timely might increase the the borrower’utes credit history in revealing financial institutions these people’lso are reputable with debt payment.

By using a excellent improve for low credit score is less difficult previously, on account of on the internet funding techniques your bridge borrowers with banking institutions that will concentrate on offering unsuccessful-monetary credit. Right here devices produces choices in minutes and commence deposit income especially to the justification within a day or a pair of. They also can be considered a safe substitute for payday and begin tyre sentence credits, which can have increased costs and fees.